Learn workers’ comp basics from the experts

New to workers’ compensation? We’re here to help.

What is workers’ compensation insurance? We’re glad you asked. As the work comp experts, we’re here to help answer the questions many small businesses have about workers’ comp.

What is workers' compensation?

Workers’ compensation is a type of insurance that protects businesses and their employees from the cost of workplace injuries.

Many small businesses rarely see injuries, but they may actually be the least prepared to navigate the system and control business costs when an accident does occur.

Workers’ comp is designed to cover medical bills and lost wages when someone is injured at work. Benefits can also include payments to compensate for permanent disabilities and to dependents of workers who are killed in job-related incidents.

A workers’ comp policy also covers the employer in case an injured employee brings a lawsuit for alleged negligence. In this way, insurance provides protection for both the employee and employer.

Workers’ comp policies are issued annually, with a required review or “audit” at the end of each year. The premium is calculated based on the kind of work your employees do and the amount you pay them to do it. Other factors affecting price include your business’ commitment to safety and history of claim activity. Basically, the safer you keep your workers, the less it costs you to insure them.

Why is it sometimes called workman's comp?

Workers’ comp can go by a number of different names, depending on who you talk to. Whether you hear it called “workers’ compensation,” “work comp” or “workman’s comp,” its meaning is the same.

Who needs a policy?

Any business that employs full-time, part-time, or temporary workers is a candidate to carry workers’ comp coverage.

Even businesses that do not currently have employees can have a small policy in place to cover individuals who may perform work for them in future. If you have employees, workers’ comp insurance is part of your responsibility to keeping them safe.

Generally, all employees are covered under a workers’ comp policy. In certain instances which vary by state, owners or officers of companies may choose to include or not include themselves under the policy.

What states do you cover?

We insure businesses based in Minnesota, Indiana, Iowa, Kansas, Nebraska, South Dakota, Tennessee and Wisconsin.

We also cover out-of-state operations these employers have in many other states including: Alabama, Alaska, Arizona, Colorado, Connecticut, Florida, Idaho, Illinois, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nevada, New Mexico, North Carolina, Oklahoma, Pennsylvania, South Carolina, Texas, Utah, Vermont and Virginia.

Why buy workers' comp separate from my other lines of insurance?

Simply put, because workers’ compensation is complicated and it’s best to choose someone who specializes in it.

There’s more to purchasing workers’ comp than just meeting the state’s insurance requirement. Workers’ comp is highly regulated and each state has different rules. The rules on medical and lost-time benefits for injured employees are mandated by law, and they’re complicated.

Small businesses should be able to rely on the insurer to navigate these complex systems. Because those who rarely see injuries are often the least prepared for unexpected costs, this is a relevant issue for every employer, not just those who regularly have claims.

Working with a specialized insurance company like us helps every claim get off to a good start for the best possible outcome.

Can I buy coverage from an independent insurance agent?

Absolutely. While you have the option of buying workers’ comp insurance directly from us, you may choose to work through an independent insurance agent. Many business owners find it useful to consult with an independent agency to meet their business insurance needs. An independent agent may choose to compare services and prices from a variety of carriers, recommending the package that best suits your needs.

If you’re already working with an independent agency, ask them how our coverage compares to other insurance carriers. If you’re looking for an independent agent, we’d be happy to recommend one to you. We work with some of the best ones.

What information do I need to get a quote?

The key to giving you an accurate quote for workers’ comp coverage is having a clear understanding of your business. The more information you can provide when you request a quote, the fewer questions we’ll have to follow up with.

Number of employees

The number of workers your business has on staff is important to help us determine the scope of your operation. By telling us how many full-time and part-time workers you have, you’ll avoid a whole bunch of follow-up questions that won’t apply to your business.

Total payroll

Like the number of employees, the size of your payroll is a key indicator of the scale of your operation. This information is important in tailoring your quote for coverage.

Federal ID number (FEIN)

By supplying your FEIN, you help us make sure that we accurately match our records to your business, and not some other operation with a similar name or address. Surprises can be nice, but it’s no fun getting stuck with some other employers’ claim history.

A copy of your current workers’ comp policy

If you already have coverage elsewhere, give us a copy of your current workers’ comp policy. There’s quite a bit of information we can carry forward. This prevents us from having to ask a lot of questions that you’ve probably already answered at least once.

Quote terminology key

In reviewing your quote, you may run into some terms that aren’t familiar to you. We don’t mean for our insurance policies to require a translation, but there are certain things that just have to be presented with specific language. We want you to understand everything that goes into your policy, and we’re happy to help you if the terminology ever gets in the way.

Are there different coverage options?

Unlike other lines of insurance, workers’ compensation doesn’t offer different or optional levels of coverage. Since workers’ comp benefits are spelled out by law in each state, the benefits available to the employer don’t vary from policy to policy within a given state. When your policy is in place, it covers every work-related injury considered compensable by state law. The great news here is that employers can buy a policy without having to make tough decisions on the way in.

There is, however, an exception to this basic “no options” principle when it comes to Employer’s Liability coverage. With a workers’ comp policy, the employer receives a base level of liability coverage, which protects the employer if they are sued by an employee who was injured due to alleged employer negligence (this is sometimes referred to as “Part Two” of the workers’ comp policy). This liability comes with a pre-determined maximum dollar amount. When purchasing a workers’ comp policy, an employer has the option to pay an additional fee to raise these liability limits.

How much does it cost?

The cost of workers’ compensation insurance is based on the amount of payroll paid to employees and the type of operation you run. It all comes down to what you do and how you do it. Just as certain occupations come with more risk of injury than others, certain businesses do a better job of keeping their workers safe than others. Employers with a history of maintaining a safe workplace will pay less to cover their workers than those that have workers in harm’s way.

How is my workers' compensation premium calculated?

A number of factors go into determining your workers’ compensation premium, including:

- Class code: Each state has hundreds of different codes for different types of businesses. The state workers’ compensation data collection organization issues a rate for each code based on the hazards of the operation, and past statistics. This means the rate for a concrete construction worker will be higher than the rate for a retail store clerk, because the potential for injury is higher.

- Payroll: Your estimated payroll for the next 12 months helps determine your premium. An auditor will ask for actual payroll amounts at the end of the policy period, and if it differs from the estimate, you could get a refund or need to pay an additional charge.

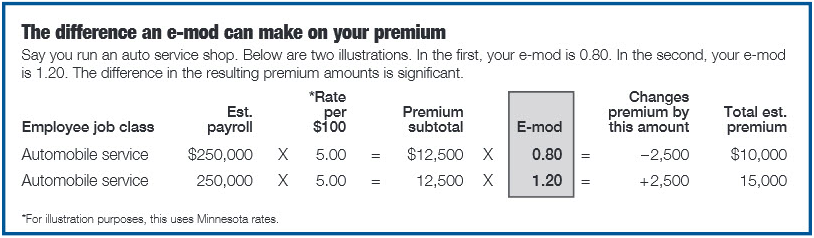

- Experience modification factor (e-mod): When calculating your workers’ compensation premium, the e-mod is a multiplier that’s based on your past workers’ compensation claim costs. If you’ve had lower workers’ comp claim costs historically than your industry peers, your e-mod will be less than 1, which saves you money on your premium. If you’ve had higher claim costs than your peers, the opposite is true. Only businesses over a certain size have e-mods.

- Load factor: Your insurance company sets this rate — which applies to all policies — to cover taxes, assessments, claims administration and other operating expenses.

- Premium discount: In Minnesota, this discount goes to policies that are more than $5,000 in premium, because it costs less to service one large account than it would to service multiple smaller accounts that add up to the same total premium.

- Expense constant: This is a flat charge applied to every policy that covers common costs such as issuing, recording and auditing.

- Schedule credit: If you’ve introduced safety initiatives or taken other measures to reduce risk, your underwriter could give you this discount on your premium. Some states don’t permit schedule credits.

- Schedule debit: If some jobs at your business are more hazardous than average for their class, you could receive a schedule debit, which increases your premium. Some states don’t permit schedule debits.

- Special compensation fund assessment: Your state could build this cost into its rates, or it might be listed as a separate charge. Either way, it goes toward a state fund that pays workers’ compensation benefits to injured workers of uninsured employers. It also covers the state’s costs for operating the workers’ compensation system, such as judicial and regulatory costs.

- Terrorism Risk Insurance Act (TRIA): This is a charge of 1-2 cents per $100 of payroll based on state guidelines. TRIA is a national program that provides federal government-backed insurance in the event of a major act of terrorism.

How do class codes come into play?

Your workers’ compensation premium is based, in part, on how dangerous your line of business is. For example window washers are more likely to be injured on the job than those at a call center.

The first step to evaluating your business’ risk level is categorizing it, by assigning it one of the hundreds of class codes defined by your state. For example, here are some Minnesota class codes:

- Hardware store (8036)

- Restaurant (9082)

- Hair styling salon (9568)

- Amusement device operation (9180)

Each state has a regulatory agency that collects payroll and claims data from all of the state’s workers’ compensation insurers. This agency sets a different rate for each class code based on that data and the risk of injury associated with that occupation. For example, an automobile mechanic’s rate may be $4.36 per $100 of payroll, while a clerical office employee’s rate is 26 cents per $100.

Some employees whose duties are common to many businesses — such as clerical workers, drivers and salespeople — can typically be classified separately, if those are their sole duties.

Comparison within class code also contributes to premium

The rate for your class code is one factor in determining your insurance premium, but so is your company’s claim history. This is reflected by a rating called your experience modification factor (e-mod), which is a multiplier based on how you compare with other companies within your class code. In general, the more injuries your business has had in the past, the higher your e-mod will be, and the more expensive your premium will be.

What are e-mods and why should I care?

An experience modification factor (e-mod for short) is a number that shows whether your workers’ compensation claim costs have historically been higher or lower than your industry peers.

Before we get into too much depth, you should know that you might not even qualify to have an e-mod. In order to be assigned an e-mod by the rating bureau, an employer’s workers’ comp premium average over three years must be above a certain dollar threshold (usually $3,000 to $7,000 depending on the state).

Here are the minimum three-year average thresholds in the Upper Midwest states for organizations with more than two years of loss history (the thresholds differ somewhat for newer organizations):

- Minnesota: $5,500

- Wisconsin: $7,250

- Indiana: $2,750

- Iowa: $4,000

- Kansas: $4,000

- Nebraska: $3,000

- South Dakota: $4,000

E-mods help determine workers’ comp premium

Still with us? Great. The main reason you might care about your e-mod is that it’s used as a multiplier to determine your workers’ compensation premium. That means if you’ve historically had lower workers’ compensation claims costs than similar companies in your industry, your premium will be lower. Of course, if your costs have been higher than your peers, your premium will be too.

The average e-mod is 1.0, so if yours is lower, it indicates a better-than-average claims history. If it’s above 1.0, it indicates your claims history is worse than average.

Here’s an example that shows how an e-mod can affect your premium:

Three years of history included in e-mods

If you’ve had a major workers’ compensation claim, you might be wondering, “Will I be paying for this forever?” The answer is no.

Your e-mod only takes into account three years of loss history, minus the most recent policy year. For example, if your policy period begins January 1, 2018, your e-mod includes claim costs for 2014 through 2016.

Some claim costs are excluded from e-mods

All claim costs are not created equal when it comes to calculating an e-mod.

If an injured employee visited a doctor, but didn’t miss any time from work beyond the state waiting period (this is three to seven days, depending on your state), only 30 percent of the claim costs are included in Minnesota, Wisconsin, Iowa, Nebraska and South Dakota (the primary states we cover).

If a single claim costs more than a state-determined split point — $16,500 in Minnesota, for example — costs over that amount are also given less weight in the e-mod calculation.

Rating bureau determines e-mod

Now that you know a little bit about how e-mods are calculated, you might be wondering who does all this calculating, anyway?

Depending on your state, it’s either your state rating bureau or the National Council on Compensation Insurance — not your insurer. These organizations use statewide data to determine expected losses for different types of operations.

Your data collection organization recalculates your e-mod each year about 90 days prior to your policy renewal date and reports it to you and your workers’ comp insurer.

But what does it all mean?

Well, the good news is that because your workers’ compensation premium is determined in part by your e-mod, it gives you some control.

So, that safety talk you gave your employees about winter slips and falls might have actually saved you some money — remember, the one that ended with that really slow, safe conga line in the parking lot?

How can I save money on my premium?

We realize workers’ compensation is a significant expense, but there are ways you can keep your premium under control.

Your premium is based, in part, on how your claims history compares with businesses similar to yours. This means that keeping your claim costs as low as possible will help prevent your premium from increasing.

Easier said than done, right? That’s true, sometimes accidental injuries are out of your control. But you’d be surprised how much control you do have. For example, slips and falls are very common causes of serious work injuries. Simply ensuring that your parking lot is shoveled and salted in the winter, and keeping your indoor work environment tidy could prevent one of these accidents.

Here are our top three tips for holding down your claim costs:

- Provide light-duty work to injured employees who have medical restrictions rather than having them stay off work until they can return to their regular jobs.

- Report claims right away. Our claims representatives are experts in making sure injured workers get the care they need to ensure a smooth and speedy recovery.

- Make workplace safety a high priority. Find many general and industry-specific resources to make your workplace safer in SFM’s resource catalog.

What is an if/any policy?

It might seem a little strange to purchase insurance for employees you don’t know you have, but that’s essentially what an if/any policy does. Sometimes a business will take out an if/any policy for protection just in case they hire a subcontractor who doesn’t have the proper coverage for its employees. For example, say a general contractor hires an intermediate contractor to perform roofing and painting on a building. Then that intermediate contractor hires a roofing crew for the day, and a member of the roofing crew gets injured. An if/any policy would protect the general contractor in the event the roofer’s employer didn’t have the proper workers’ comp coverage.

Can I backdate my coverage to start at an earlier date?

Your workers’ comp coverage begins on the effective date you request when the policy is issued (or “bound” as we call it). You can request a date in the future for your effective date, but your policy can’t be backdated to an earlier date.

Does SFM offer pay-as-you-go wage reporting?

Yes, pay-as-you-go wage reporting is available to businesses with at least $1,000 in premium. This is most beneficial for businesses with cash flow fluctuations due to seasonal work like construction, landscaping and hospitality. Wage reporting allows them to periodically report payroll for class codes and make corresponding premium payments. Wages can be reported and premiums can be paid monthly, quarterly or semiannually. They can be paid online or by invoice depending on premium size. To learn specifics, check out our wage reporting brochure.

What happens if I have a claim?

Call us anytime. We’re here whenever you need us. Our 24-hour work injury hotline puts you in touch with a registered nurse specifically trained in handling work injuries when you need it most — right after an injury happens. The sooner we know about an incident, the better we can help the injured employee receive the appropriate care and be on the way to recovery.

More details on reporting injuries to SFM can be found at sfmic.com.

Want to learn more? Make sure to check out our blog for more workers’ compensation tips.

Quick and easy quotes

Now that you’re up to speed on workers’ comp, answer a few simple questions to request a quote.